Business Journey Observability across the Bank’s high impact and high visibility customer transactions with a comprehensive birds-eye view for IT operations, enabled by vuSmartMaps™.

The integration of the Bharat Bill Payment System (BBPS) in India’s financial services sector has revolutionized bill payments. BBPS, a centralized platform, facilitates interoperability and simplifies bill payments across multiple sectors. Yet, the challenge remains to ensure seamless operations and customer satisfaction in this complex ecosystem. This is where advanced observability solutions play a crucial role.

The BBPS value chain involves multiple entities, including the Bharat Bill Payment Central Unit (BBPCU), Bharat Bill Payment Operational Units (BBPOU), billers, and agents. The challenges in this landscape include:

![]()

● Complex Interactions: Multiple stakeholders, from billers to financial institutions and service agents, interact within the system, creating a complex web of transactions.

● Handling High Transaction Volumes: Managing vast payment volumes across diverse segments such as utilities, telecom, and municipal fees.

● Addressing Technical and Business Declines: Ensuring efficient handling of transaction failures due to technical or business issues.

● Maintaining System Performance: Upholding high system uptime and performance critical for customer satisfaction and compliance.

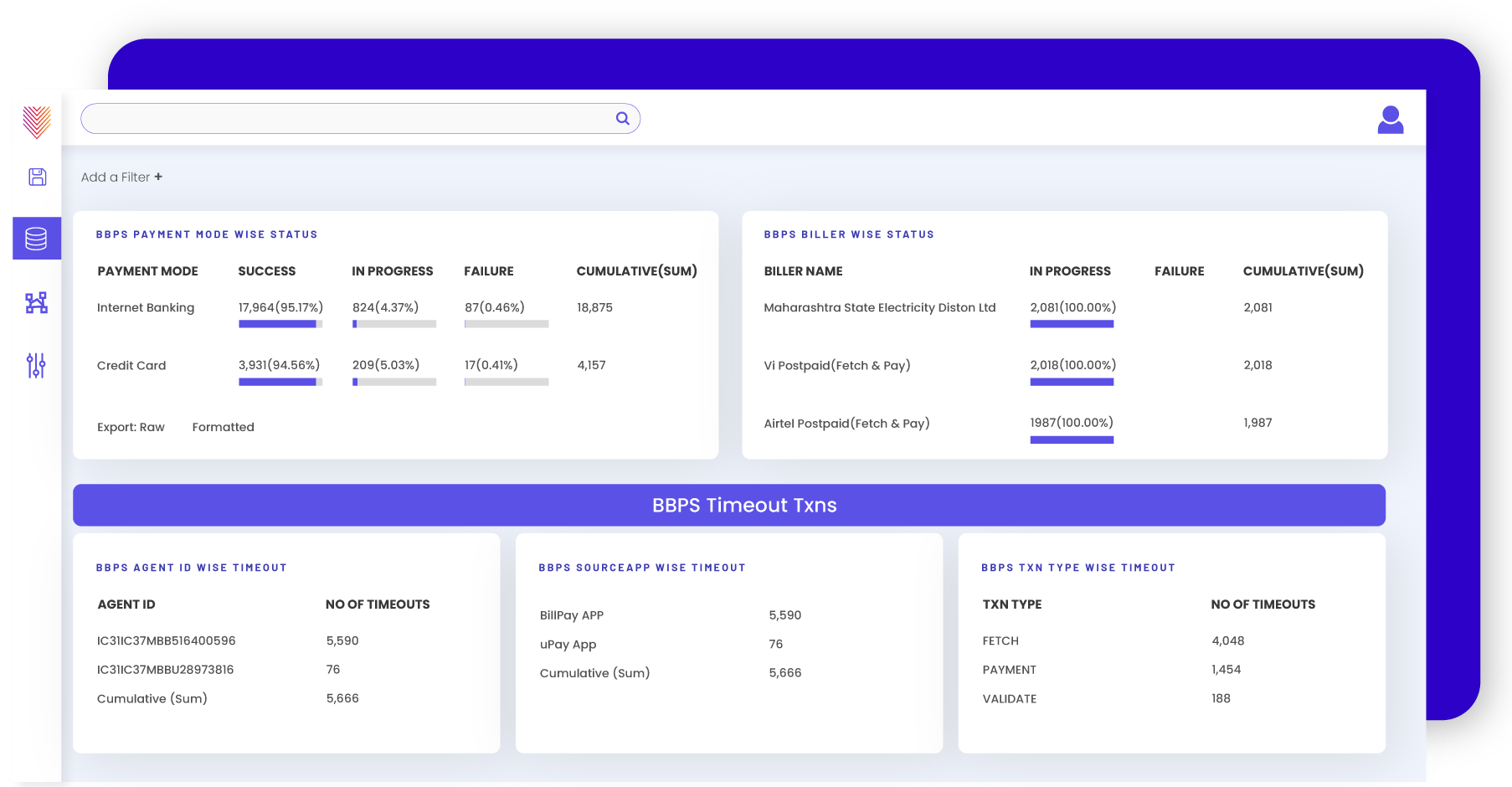

VuNet’s solution enhances the BBPS with detailed, real-time operational insights and linking the IT performance to business impact:

● Real-time Transaction Observability: The platform provides a comprehensive view of all transactions, enabling instant identification and isolation of failures.

● API and ecosystem Performance Visibility: Full stack visibility of the infrastructure, API interconnects and 3rd party interfaces through a journey map to accelerate incident response to failures.

● Biller Performance Tracking: It allows for a constant view of biller performance, ensuring each component of the ecosystem functions optimally. Observe Biller level transaction performance through customized dashboards.

● Intelligent Notifications: Instantly highlight variations in latency and error rates through notifications based on dynamic thresholds.

● Advanced Analytical Insights: The solution offers sophisticated analytical capabilities, allowing for deep dives into specific issues and trends within the BBPS operations across the various dimensions of the business journey facilitating a 360-degree view of the eco-system.

● Automated Reporting: Scheduled and on-demand reporting of transaction performance across any entities or dimensions.

The solution enhances the efficiency and reliability of financial transactions, leading to reduced failures and improved customer experience.

With comprehensive insights into transaction patterns and biller performances, decision-making is more informed, optimizing overall payment processes.

Reduced transaction failures and enhanced reliability of the system directly translates to higher customer satisfaction and trust in the BBPS ecosystem.

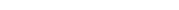

Fig – VuNet’s Observability solution showing key metrics for BBPS Operations

Fig – VuNet’s Observability solution showing key metrics for BBPS Operations

Browse through our resources to learn how you can accelerate digital transformation within your organisation.